Jun 23, 2017

BlackBerry shares tumble amid revenue miss

The Canadian Press

WATERLOO, Ont. -- BlackBerry (BB.TO) is reporting a US$671 million profit for the first quarter but its revenue was lower than expected, missing analyst estimates.

The company says its revenue for the quarter was US$235 million – compared with estimates of US$264.39 million, according to Thomson Reuters data.

The negative surprise in sales seemed to have more impact with stock traders than the profit, with BlackBerry shares falling in extended trading shortly after the announcement.

BlackBerry's TSX-listed shares dropped $1.80, or 12.28 per cent, on Friday to close at $12.86.

The company's shares had risen in recent weeks amid speculation that BlackBerry could be a takeover target and its stock could rise substantially in future.

- Why John Chen won't be overpaying for acquisitions anytime soon

- BlackBerry shares tumble amid revenue miss

- Bay Street still split on BlackBerry despite 68% surge since March

RELATED

While first-quarter profit was large for the Waterloo, Ont.-based company, it was also mostly because of a one-time payment received as a rebate from Qualcomm – one of its suppliers – after an arbitrator ruled in BlackBerry's favour.

With the Qualcomm payment and other items included, BlackBerry's reported profit was equal to US$1.23 per share -- compared with a year-earlier loss of US$1.28 per share or US$670 million in last year's first quarter.

On an adjusted basis that excludes the impact of Qualcomm, BlackBerry's operating income was only US$14 million or two cents per share -- but that was ahead of estimates that predicted the company would break even during the quarter.

Revenue was down from US$400 million in last year's first quarter and down from US$286 million in the fourth quarter ended Feb. 28, but BlackBerry said it's on track to meet full-year financial estimates.

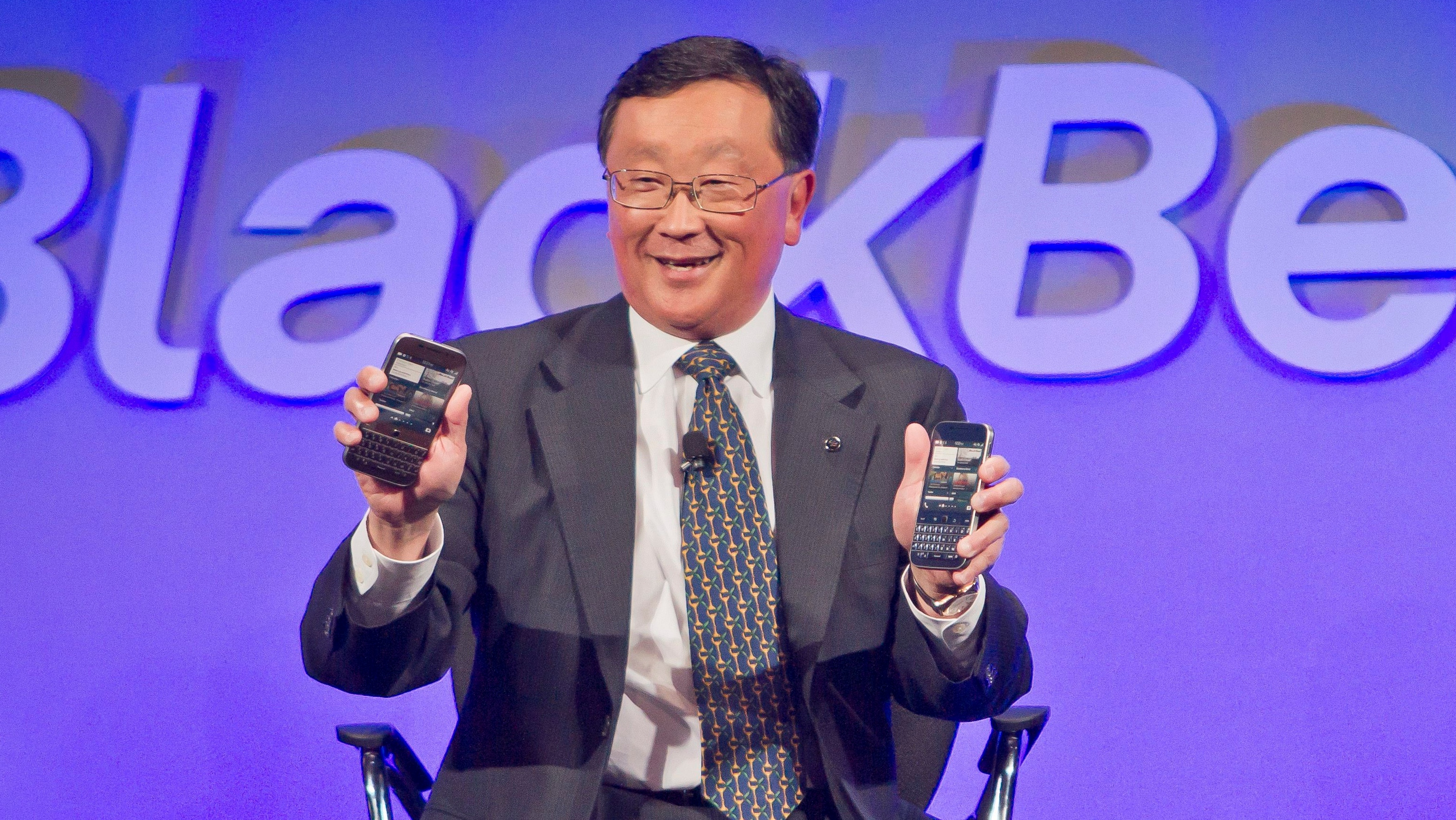

"In Q1, we made great progress strengthening our strategic position in emerging growth markets, most notably in cybersecurity and the enterprise of things," said John Chen, BlackBerry's executive chairman and CEO, in a statement.

"Our outlook for fiscal 2018 is unchanged. We expect growth at or above the overall market in software and services. We also expect to be profitable on a non-GAAP basis and to generate positive free cash flow for the full year, excluding the benefit of the Qualcomm arbitration award."

Despite the early pullback in BlackBerry's shares, they are still up since April.

The increase came as Citron Research published a report saying BlackBerry is a likely buyout target at a sizable premium, now that its transition from hardware maker to software company is nearly complete.

Citron also projected BlackBerry's shares were likely to reach US$20 on the Nasdaq within 24 months, echoing a Macquarie Research analyst's report from mid-May that said the company's shares could jump to US$45 by 2020.

BlackBerry's 52-week high on Nasdaq is US$11.74.

The company once famous for its smartphones said in September that it would exit the hardware business to focus on growing its software business, which includes highly secure communications and products for the automotive industry.

HAVE YOUR SAY