Jul 16, 2019

JPMorgan slips after net interest income outlook cut

, Bloomberg News

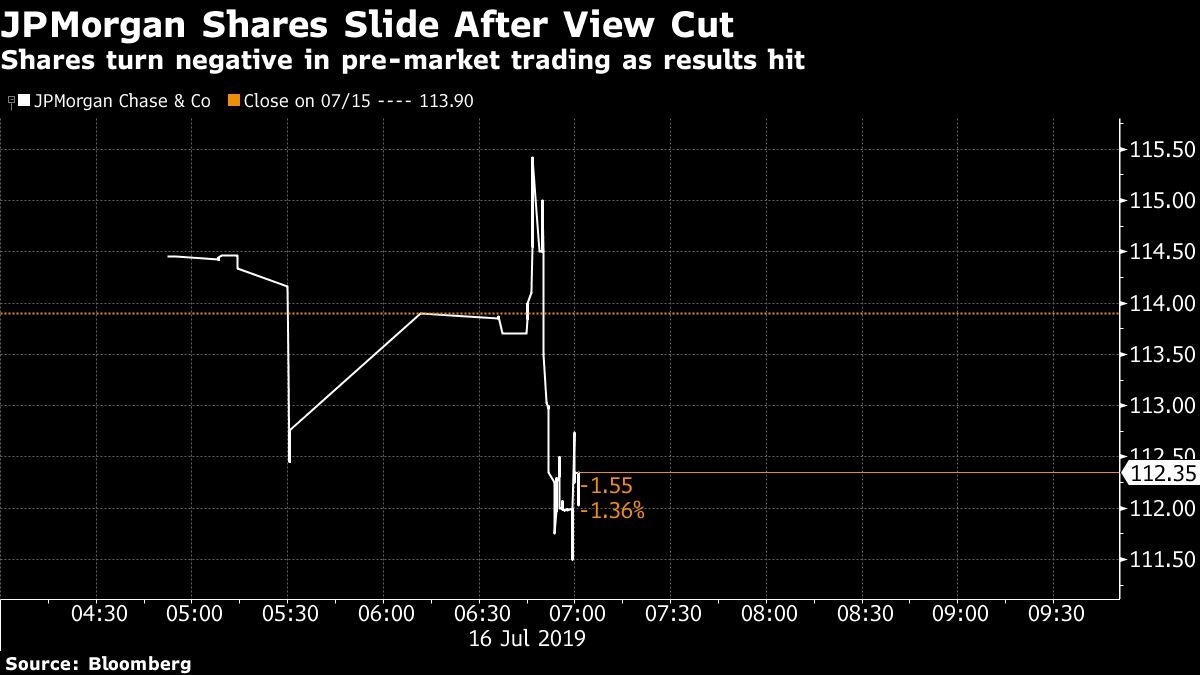

JPMorgan Tops Q2 Revenue, Cuts Net Investment Income Outlook

JPMorgan Chase & Co.’s (JPM.N) shares are slipping about 1.7 per cent in pre-market trading after the bank cut its net interest income, or NII, view. JPMorgan now sees year NII of about US$57.5 billion; previously, it saw at least US$58 billion.

After Citigroup Inc.’s net interest margin missed estimates on Monday, analysts had worried about other banks’ results. Evercore ISI’s Glenn Schorr told investors not to have a “false sense of security for the lower NII adjustments coming for the rest of the group.” Goldman Sachs Group Inc. and Wells Fargo & Co. are due to report Tuesday morning as well.

JPMorgan’s second-quarter results weren’t all bad. Adjusted earnings per share of US$2.59 topped estimates of US$2.50. And, the bank continues to see “positive momentum with the U.S. consumer -- healthy confidence levels, solid job creation and rising wages -- which are reflected in our Consumer & Community Banking results,” CEO Jamie Dimon said in the earnings statement. Double-digit credit card sales and merchant processing volume growth reflected “healthy consumer spending.”