Apr 25, 2017

'That's not right': Cenovus shareholder seeks to halt ConocoPhillips deal

Reuters

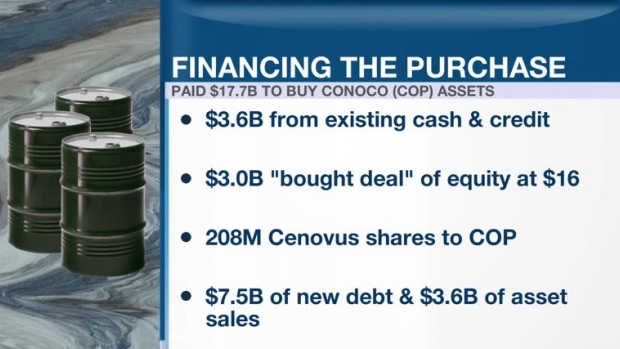

A Cenovus Energy Inc (CVE.TO) shareholder has asked a Canadian regulator to halt the company's recent $17 billion purchase of some ConocoPhillips (COP.N) assets, saying the new stock issued to help fund the deal has diluted the value of Cenovus shares.

Toronto-based Coerente Capital Management has filed a letter with the Ontario Securities Commission, Len Racioppo, Coerente's managing director, said Tuesday.

"They offered 24.96 per cent to Conoco and then they did 22.5 per cent by way of a bought deal, thereby avoiding it. In the end, shareholders have been diluted by 47.5 per cent and that’s not right," he told BNN in an interview.

Racioppo believes Cenovus shareholders deserve a say in the matter.

"You don’t participate in the markets one day, owning a share and then [wake] up the next day to [find] a company that’s very different with a very different risk profile," he told BNN.

"Shareholders should get a vote and that’s what’s really perplexing here is why the board would have allowed this to come forward without a vote."

Cenovus last month agreed to buy most of ConocoPhillips' Canadian oil and gas assets in a deal that effectively doubled the size of the Canadian oil company, but dented its pristine balance sheet and pushed it into the largely unknown territory of natural gas.

Racioppo said that the deal to move back out to the oil sands is a surprise for the company.

"We thought it was a very low-risk play in the oil business. It's not anymore," Racioppo said.

"If oils do go back down to US$40 - and I'm not certain that they will - they'll be in trouble."

Cenovus shares were up 0.64 per cent on Tuesday, trading at $14.24 at 3:30 p.m. ET, after having lost about a fifth of their value since the deal was announced. The commission declined to comment, and Cenovus did not immediately respond to a request for comment.

- with files from BNN