Jan 26, 2017

BNN's Daily Chase: TSX continues pursuit of record highs with the Dow above 20,000

By Andrew Bell

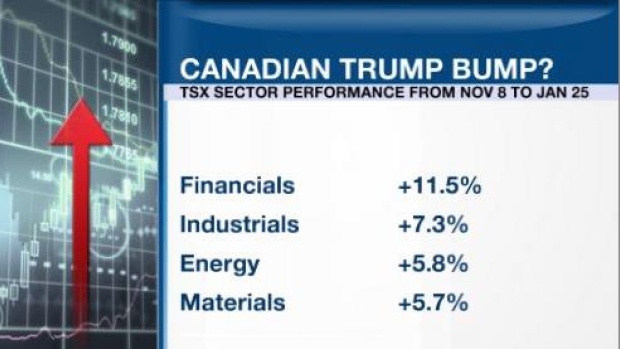

The markets will be the focus once again today as the TSX tries again to finish the session at a record high. The exchange’s benchmark index briefly traded above its all-time closing high yesterday, hitting 15,673.90 points. But it ended shy of its closing record level of 15,657.63 on September 3, 2014.

Toronto energy stocks are down by almost half since August of that year but financials such as Royal Bank (RY.TO) have lifted the Toronto market, trading at or near their own record highs. Rising interest rates in the United States have helped to boost Sun Life (SLF.TO) almost 20 per cent in the past three months while Manulife (MFC.TO) is up a brisk 30 per cent.

BNN managing editor Noah Zivitz has us digging behind the index gains today to look at stocks that have missed out: Hudson’s Bay (HBC.TO) has tumbled close to 35 per cent since the Nov. 8 U.S. election and Fairfax Financial Holdings (FFH.TO). is down more than 12 per cent.

With the venerable Dow Jones average breaching 20,000 yesterday for the first time, we’re also checking out U.S. laggards that could yet have their day. We’ll hear from Paul Hickey, co-founder of Bespoke Investment Group. He offers a twist on the traditional Dogs of the Dow strategy that advises investors to investors to buy high-yielding stocks on the theory that they represent better value. He’ll suggest a Dogs of the Nasdaq 100 approach – buying shares in the tech-heavy index that sport the highest stream of income.

ENERGY SELLOFF

On Commodities yesterday we explored the relative selloff in Canadian energy stocks since November amid fears that a resurgent energy sector under Donald Trump offers better growth. Trimark Resource Fund manager Norman MacDonald (whose fund soared 49% in 2016) told us the slide has been “unbelievable” but investors should still focus on companies with rich cash flow.

“[Mutual fund giant] Fidelity has been blowing out major positions in Spartan, Raging River, Arc, Peyto, and others,” according to Sprott Asset Management energy specialist Eric Nuttall.

He has trimmed Canadian exposure in the Sprott Energy Fund but he says now is a time to deploy capital when others are fearful. Nuttall joins Business Day AM at 9:35 a.m. ET.

DRUG WARS

As Canada nears legalization of recreational cannabis, we’re talking about the gigantic global drug market on Commodities at 11:50 a.m. ET. Liberalization of marijuana rules in the United States is said to have spurred the Mexican drug gangs to step up their shipments of heroin and methamphetamine.

We’ll get international insight from Mike Vigil, former chief of international operations for the U.S. Drug Enforcement Administration. He’s a former undercover agent (rather him than me) and author of the book Deal, which recounts his adventures.

Every morning Commodities host Andrew Bell writes a ‘chase note’ to BNN's editorial staff listing the stories and events that will be in the spotlight that day. Have it delivered to your inbox before the trading day begins by heading to www.bnn.ca/subscribe.