Jan 18, 2019

Personal Investor: Rise above market madness with market-neutral strategies

By Dale Jackson

The past few months have probably been a boon for antacid manufacturers as investors watch their retirement savings flap in the winds of market volatility. It’s a given that the only way to grow your saving is through risk, but there is a strategy that claims to generate positive long-term returns.

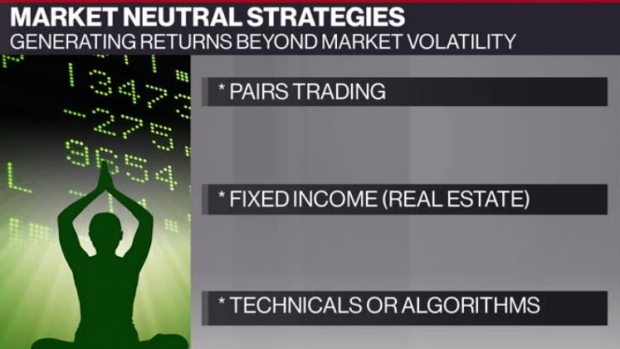

It’s called market-neutral investing: an unlimited arsenal of investment strategies that targets returns with no regard for movements or general trends in the stock or bond markets.

Most investment advisors can initiate a market-neutral strategy to a certain degree. Some money managers employ market-neutral strategies only on a client-by-client basis,or through market-neutral hedge funds. Among the strategies used are holding long and short positions simultaneously, buying fixed-income vehicles, or acting on technical analysis or algorithms.

There are a handful of market-neutral funds available on the Canadian market. Most have short track records but even those that post returns are difficult to compare with benchmarks like the S&P 500 or the Toronto Stock Exchange, because their objective is to have no correlation to those benchmarks.

As hedge funds, market-neutral funds are not required to disclose a great deal of information. Tracking – or even understanding them – can be difficult, which makes many skeptics question whether market-neutral investing is even possible.

Fees on market-neutral funds can also be confusing. In most cases, a performance fee is tagged on to a standard annual fee based on a percentage of the total amount invested.